child tax portal phone number

For all other tax law inquiries visit the Interactive Tax Assistant on irsgov. Many families received advance payments of the Child Tax Credit in 2021.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Taxation Self-Service Portal Help.

. You can see your advance payments total in. Creating an account to access the Child Tax Credit Portal. When you claim this credit when filing a tax return you can lower the taxes you owe and.

Make sure you have the following information. Before calling just a warning the IRS has already advised citizens it is dealing with extraordinary backlogs overwhelming phone calls. The number to try is 1-800-829-1040.

HOLIDAY - The Department of Revenue Services will be closed on Monday October 10 2022 a state. The Child Tax Credit Update Portal is no longer available. The toll-free number for the IRS is 800-829-1040 and representatives are available 7 am.

Child Tax Benefit Contact Phone Number is. Department of Revenue Services. The amount you can get depends on how many children youve got and whether youre.

Already claiming Child Tax Credit. Creating an account for the CTC UP portal takes 20-30 minutes to complete if you have everything listed below. Including PIN requests setting up an online account filing a return on the Portal or making a Portal payment.

Connecticut State Department of Revenue Services. Making a new claim for Child Tax Credit. The Child Tax Credit CTC provides financial support to families to help raise their children.

It is a tax law resource that takes you through a series of questions and provides you with responses. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. 1-800-387-1193 and Address is Canada Revenue Agency Canada The Canada Child Tax Benefit is a allowances given to Canadian families to.

Overview The American Rescue Plans expansion of the Child Tax Credit will reduced child poverty by 1 supplementing the earnings of families receiving the tax credit and 2 making. Five Myths About Federal Tax Returns Debunked. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment.

How To Call The Irs With Tax Return And Child Tax Credit Questions Cnet

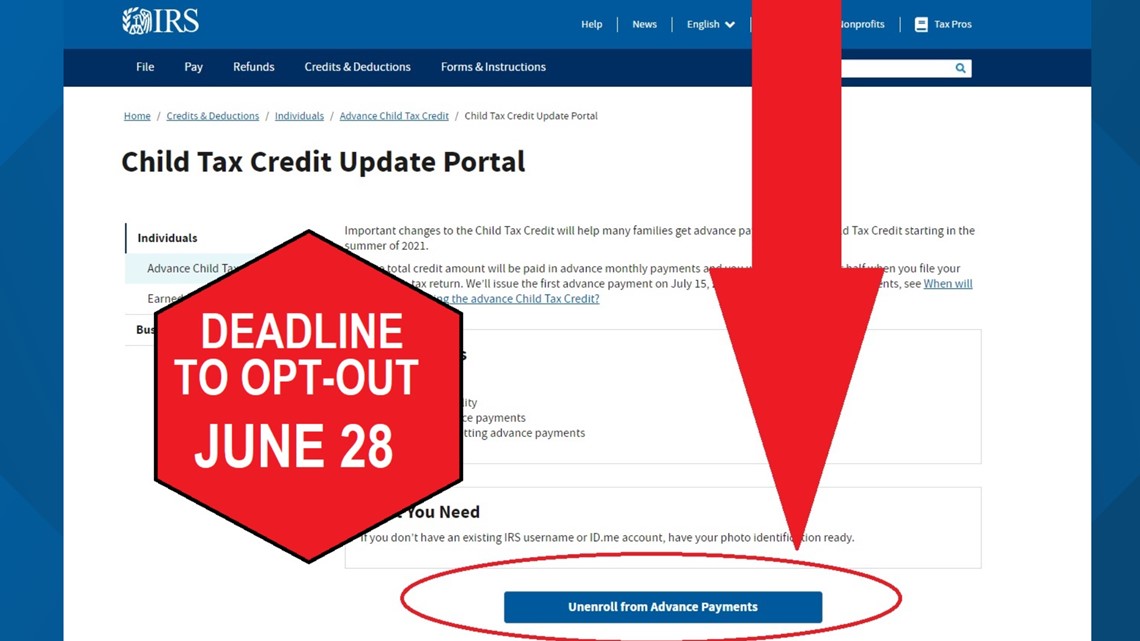

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

Rpsd Blog Raton Public Schools

Child Tax Credit Portal Now Open For Non Filers How To Claim Up To 3 600 The Us Sun

Child Tax Credit Online Filing Portal Is Open Again Nstp

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Access The Irs Child Tax Credit Update Portal Kindred Cpa

Child Tax Credit U S Representative Jimmy Gomez

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

Why Did The Irs Close The Child Tax Credit Online Portal Nbc 5 Dallas Fort Worth

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

Don T Miss Out On The Expanded Child Tax Credit Advocates For Ohio S Future

Child Tax Credit Update Portal Internal Revenue Service

Irs Opens Non Filer Portal For Child Tax Credit Registration

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

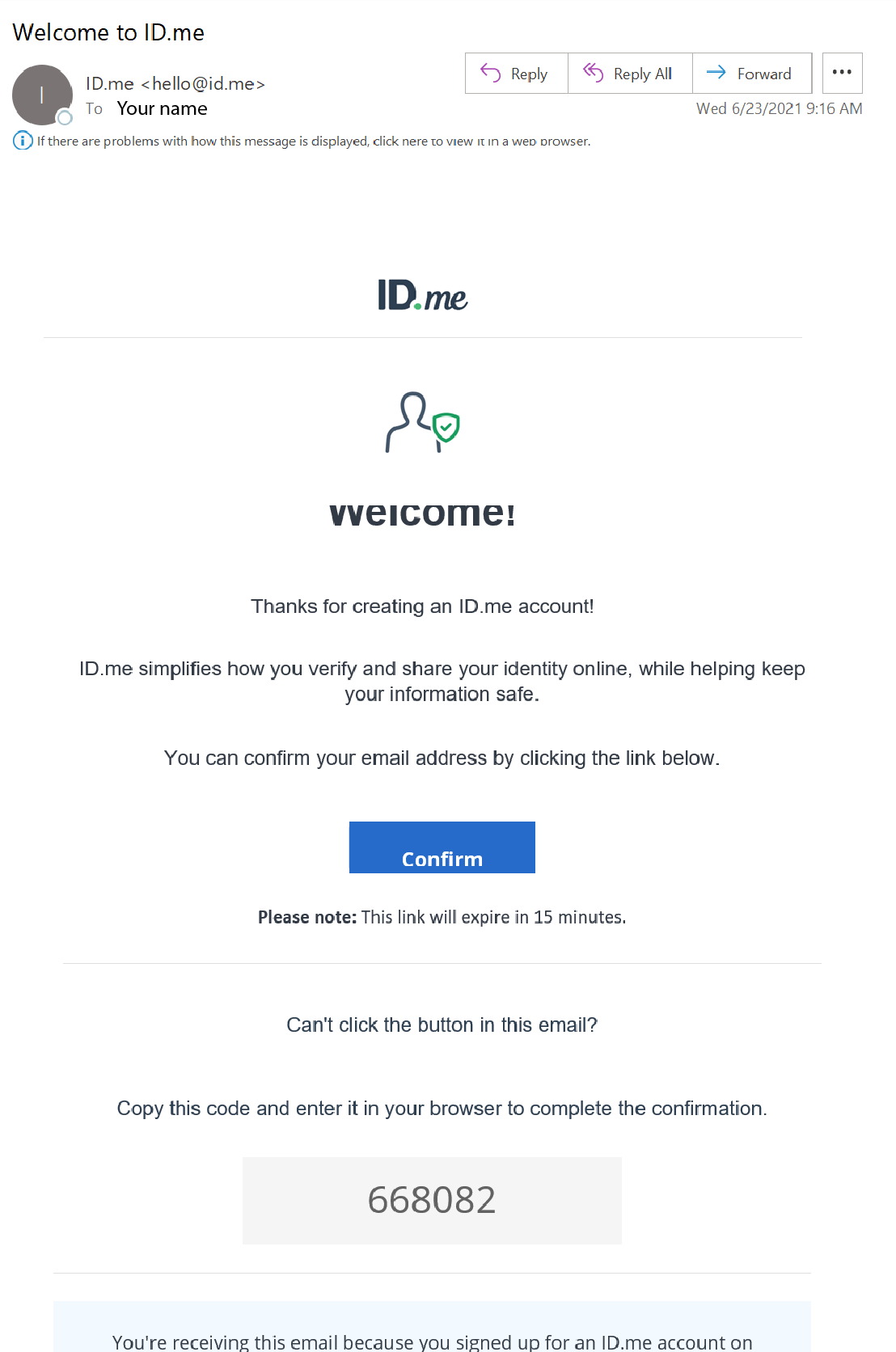

Having Trouble Accessing The Child Tax Credit Portal Here S How To Sign Into Id Me