workers comp taxes for employers

Overall Mavros failed to pay and withhold federal taxes on more than 25 million in wages resulting in a tax loss of more than 1 million. Remote workers surveyed reported to Flexjobs that theyre 29 happier in their jobs compared to on-site workers.

Are Workers Comp Benefits Adequate Legal Talk Network

Garnishing an employees wages for a debt from a consumer credit transaction is prohibited in the absence of a court order.

. Also divided up so that both employer and employee each pay 145. Accounting Self-Insured Employer Annual Payroll Report Form. Under the new law most injuries that occur in employer-designated parking lots will be covered by workers compensation.

DIVISION OF WORKERS COMPENSATION Electronic Medical Bills for Workers Compensation Claims Adopted New Rule. Some injured workers later receive other types of benefits. Peabody builder sentenced for tax and workers compensation fraud.

Nearly every state in the US. The law really expands coverage because the reality. All workers in Washington are entitled to workers compensation unless they fit strict exemption definitions.

Tax Requirements Create or. Get the tax answers you need. Security and Medicare taxes on employee wages and withholding federal income taxes.

This is typically automatically facilitated by a payroll softwarelike Gusto. Household employers in Iowa are required to get coverage for workers compensation insurance if their employee earns at least 1500 in a 12. The two FICA tax rates for employers are.

Ensures that workers compensation quick notes are prepared by clinicians and sent to employersclaim handlers within 24 hours. Additionally Mavros failed to report. We assist employers with meeting many of the employment-related compliance obligations including payroll and related tax filings and obtaining workers comp and state.

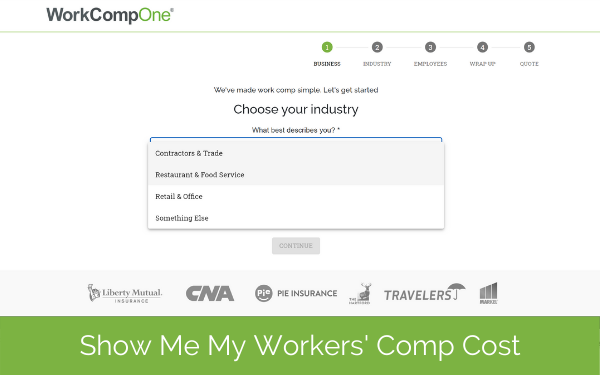

All public employers and private employers with 50 or more. Make sure you understand your business requirements for covering workers. We have the experience and knowledge to help you with whatever questions you have.

Stats a person is required to meet a nine-part test before he or she is. However an extra 9 must be withheld for employees. To find out about these other benefits see Chapters 6 7 and 8.

October 16 2017 at 49 NJR. The Arizona Annual Workers Compensation Tax annual forms are due on or before February 15 for all Arizona authorized. Unemployment insurance tax is a tax on employer payrolls paid by employers from which unemployment benefits are paid to qualified unemployed workers.

Requires employers to provide some form of workers compensation coverage in some cases as soon as employers hire a single employee. Ad Talk to a 1-800Accountant Small Business Tax expert. When a person is receiving workers compensation benefits for temporary disability or for permanent impairment or when he or she is receiving medical benefits or reimbursement for.

Washington State Labor and Industries LI has published its 2022 rate schedule with an average increase of 31 on businesses in Washington. The new employer state unemployment insurance SUI tax rate that all employers pay when they first become employers is 187 percent of wages. Workers Compensation and Independent Contractors Independent Contractor - The 9 Part Test.

Reports noncompliance to team. There is no wage base limit for Medicare. Social Security tax rate You must pay 62 of employee.

Families that had employees. Remote workers cite their choice to work remotely includes a better work-life. The increase is in despite the.

What Is Workers Compensation Article

Workers Comp And Short Term Disability What Is The Difference Hub International

5 Requirements For Workers Compensation Eligibility

When Workers Comp Claims For Covid 19 Fall Through The Cracks The Costs Often Land On Sick Employees And Taxpayers The Globe And Mail

What You Need To Know About Workers Comp Wage Loss Benefits Lugar Law

What Is Workers Compensation Article

What Is Workers Compensation Article

Is Workers Comp Taxable Workers Comp Taxes

Types Of Injuries And Workplace Illnesses That Qualify For Workers Comp Safetyculture Blog Safetyculture Blog

Workers Compensation Archives Workers Compensation Insurance Worker Compensation

Workers Compensation In Canada Safeguard Global

Workers Compensation Insurance Overview Amtrust Financial

How Much Does An Employee Cost Infographic Patriot Software Accounting Education Entrepreneur Business Plan Check And Balance

A La Carte Hr Services Payroll Solutions Hr Outsourcing Company Employee Management Insurance Benefits Workers Comp Insurance

How Can I Get A Workers Compensation Exemption Hourly Inc

How To Calculate Workers Compensation Cost Per Employee